If you’ve ever provided liquidity to a DeFi pool and walked away with less money than if you’d just held your tokens, you’ve experienced impermanent loss. It’s the sneaky, often misunderstood risk that quietly drains value from your DeFi yield farming positions while you’re busy watching APY numbers.

I learned this lesson the hard way. In early 2022, I deposited about $8,000 worth of ETH and USDC into a liquidity pool, chasing a juicy 40% APY. Three months later, ETH had rallied hard. I withdrew my position feeling pretty good about myself. Then I did the math. I’d have been $2,400 richer if I’d just held my ETH in my crypto wallet and done absolutely nothing.

That sting taught me everything I’m about to share with you.

What Impermanent Loss Actually Is (Without the Math Jargon)

Let’s cut through the noise. Impermanent loss is the difference between what your tokens would be worth if you’d simply held them versus what they’re worth after sitting in a liquidity pool. It’s an opportunity cost, and it bites harder than most people expect.

The Simple Definition: Losing Money vs Just Holding

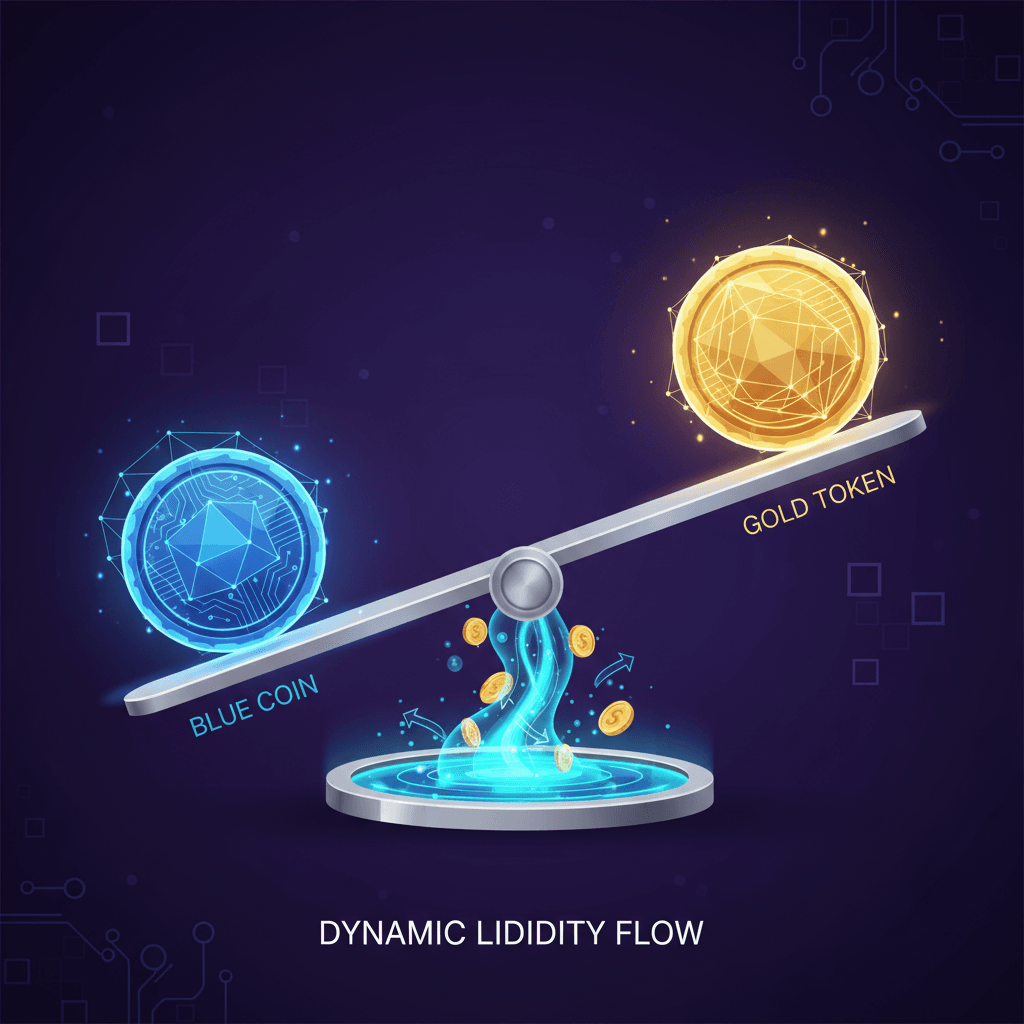

Here’s the core concept: When you provide liquidity to an automated market maker (AMM) pool, you’re depositing two tokens. The pool automatically rebalances your position as prices change. This rebalancing means you end up with different amounts of each token than you started with.

If one token’s price rises significantly, the pool sells some of it to maintain balance. You end up holding less of the winner and more of the other token. When you withdraw, you’ve missed out on gains you would’ve captured by simply holding.

Why It’s Called “Impermanent” (Spoiler: It Usually Becomes Permanent)

The “impermanent” part is technically true but practically misleading. The loss only disappears if token prices return to exactly the same ratio they had when you deposited. How often does that happen in crypto? Almost never.

Once you withdraw your liquidity at a different price ratio, the loss crystallizes. It becomes very permanent. The name really should be “potentially reversible loss if you’re extremely lucky with timing.” But that doesn’t roll off the tongue.

My $2,400 Lesson: The ETH/USDC Pool That Taught Me Everything

Back in January 2022, I was fresh off a solid year of trading gains and feeling invincible. A dangerous mindset, as anyone in my risk management strategies article knows I now preach against.

I deposited 2 ETH (worth ~$4,000) and $4,000 USDC into a popular liquidity pool. ETH was around $2,000 at the time. The pool was offering roughly 40% APY in trading fees and token rewards. Looked like free money.

Over the next three months, ETH climbed to around $3,200. Great news for ETH holders. Not so great for me. When I withdrew, the pool had automatically sold off chunks of my ETH during the rally to maintain its balance. I pulled out about 1.4 ETH and $5,100 USDC.

My LP position was worth roughly $9,580. Not bad, right? Except if I’d just held my original 2 ETH plus $4,000 USDC, I’d have had $10,400. The “free money” APY I earned was around $600 in fees and rewards. My net loss versus holding: about $2,400.

I sat there staring at my calculator, feeling like an idiot. The APY looked great on paper. The actual result made me want to throw my laptop.

How Impermanent Loss Actually Happens Behind the Scenes

Understanding the mechanics helps you predict when IL will hit hardest. It’s not random. It follows predictable math driven by how automated market makers function.

Understanding Automated Market Makers (The Pools That Cause IL)

Traditional exchanges use order books where buyers and sellers set prices. AMMs work differently. They use smart contracts to create liquidity pools. These pools hold reserves of two tokens and use mathematical formulas to determine prices automatically.

When someone wants to swap Token A for Token B, they trade against the pool itself, not another user. The pool adjusts its prices based on supply and demand within the pool. This is elegant but creates the impermanent loss problem. If you want the technical details, Uniswap’s explanation of how automated market makers work covers the mechanics thoroughly.

The Constant Product Formula: x * y = k (What It Means for Your Money)

Most AMMs use the constant product formula: x times y equals k. Here x and y are the quantities of each token in the pool, and k is a constant that stays the same after trades (ignoring fees).

This formula means when someone buys Token A from the pool, they’re adding Token B. The ratio changes, and so does the price. The pool always maintains liquidity but constantly rebalances your position.

For your money, this means:

- Price goes up: Pool sells your appreciating token, you end up with less of it

- Price goes down: Pool buys more of the depreciating token, you end up with more of it

- Either direction hurts: You always end up holding more of whichever token performed worse

How Arbitrage Traders Rebalance Your Liquidity (At Your Expense)

Here’s what actually triggers the rebalancing. When ETH’s price moves on cryptocurrency exchanges, your LP pool doesn’t automatically update. It still reflects the old price until someone trades.

Arbitrage traders spot this price difference. If ETH is $2,100 everywhere else but your pool still prices it at $2,000, arbitrageurs buy the cheap ETH from your pool and sell it elsewhere for profit. They keep doing this until the pool price matches external markets.

Their profit comes from somewhere. It comes from you and the other liquidity providers. Every arbitrage trade extracts a tiny bit of value from the pool, and that extraction accumulates into your impermanent loss.

The Real Math: How Much Can You Actually Lose?

Let’s get concrete. I know math isn’t everyone’s favorite, but these numbers matter when real money is on the line.

The Breakeven Chart Everyone Should See

Here’s what impermanent loss looks like at various price changes. This assumes a standard 50/50 liquidity pool:

Impermanent Loss by Price Change

- 1.25x price change: 0.6% loss vs holding

- 1.5x price change: 2.0% loss vs holding

- 2x price change: 5.7% loss vs holding

- 3x price change: 13.4% loss vs holding

- 5x price change: 25.5% loss vs holding

Notice something important: these percentages apply whether the price goes up OR down by that multiple. A 2x increase creates the same 5.7% IL as a 50% decrease. Only the ratio change matters.

Real Example: ETH Doubles From $2,000 to $4,000

Let’s walk through a concrete scenario. You deposit 1 ETH ($2,000) and 2,000 USDC into a pool. Total value: $4,000.

ETH doubles to $4,000. If you’d just held, you’d have:

- 1 ETH at $4,000 = $4,000

- 2,000 USDC = $2,000

- Total: $6,000

But your LP position rebalanced. After the constant product math, you now have roughly:

- 0.707 ETH at $4,000 = $2,828

- 2,828 USDC = $2,828

- Total: $5,656

Your impermanent loss: $6,000 minus $5,656 = $344. That’s 5.7% of what you would’ve had, which matches our chart above for a 2x price move.

The pool sold 0.293 of your ETH during the rally. Those were $1,172 in gains you didn’t capture.

The 5.7% Rule: Why a 2x Price Move Costs You That Much

The 5.7% figure for a 2x price change comes directly from the constant product formula. You can use an impermanent loss calculator to run your own scenarios, but the math is consistent.

What makes this painful is compound growth working against you. That 5.7% loss compounds every time you would have added to a winning position. You’re not just losing 5.7% once. You’re losing the growth that money would have generated.

When Does Impermanent Loss Actually Matter? (And When It Doesn’t)

Not all liquidity provision is a losing game. Some pools generate enough fees to offset IL. The key is knowing which situations favor you.

Trading Fees Can Offset IL (But Usually Don’t)

Every trade in your pool generates fees (usually 0.3% to 1%). These fees go to liquidity providers proportionally. In theory, high-volume pools generate enough fees to make IL irrelevant.

In practice? The math rarely works out. To offset a 5.7% impermanent loss (from a 2x price move), you’d need to earn more than 5.7% in fees during that period. Most pools don’t generate that kind of volume consistently.

The break-even math is brutal: to offset a 40% price movement, you need roughly 20% APY from fees alone. Not total APY including token rewards. Pure fee income. Very few pools deliver that sustainably.

The Brutal Reality: 51% of Uniswap V3 LPs Are Unprofitable

Here’s the statistic that should make every would-be liquidity provider pause. According to academic research on impermanent loss statistics and data from Bancor, over 51% of Uniswap V3 liquidity providers are unprofitable even after accounting for fee income.

Read that again. More than half of LPs would have been better off just holding their tokens. And these are mostly sophisticated DeFi users, not beginners.

The edge cases where LPs profit consistently tend to be either:

- Extremely high-volume pools with stable price ratios

- Professional market makers with advanced hedging strategies

- People who got lucky with timing

For the average person? The odds aren’t in your favor.

Stablecoin Pairs vs Volatile Pairs: Night and Day Difference

This is where strategy actually matters. A USDC/DAI pool experiences almost zero impermanent loss because both tokens maintain roughly equal value. Price divergence is minimal.

Compare that to an ETH/SHIB pool. The price ratio between those tokens can swing wildly in days. Massive IL is almost guaranteed during volatile periods.

The rule is simple: the more correlated your token pair’s prices, the less IL you’ll experience. Stablecoin pairs are safest. Pairs like ETH/stETH or WBTC/renBTC (tokens pegged to the same underlying asset) are relatively safe. Random altcoin pairs against ETH or stables? High risk for IL.

How to Actually Protect Yourself From Impermanent Loss

I’ve lost enough money to IL that I’ve developed a framework for when to provide liquidity and when to stay away. Here’s what works.

Strategy 1: Stick to Stablecoin or Correlated Pairs

If you want to earn yield through liquidity provision without the IL headache, stablecoin pairs are your safest bet. USDC/USDT, DAI/USDC, and similar pairs have minimal price divergence.

The yields are lower (often 2-8% APY) but the risk is dramatically reduced. You’re earning consistent income without gambling on price ratio changes.

For slightly higher yields with manageable risk, look at correlated asset pairs: ETH/stETH, WBTC/renBTC, or similar. These maintain close price correlation while offering better returns than pure stablecoin pools.

Strategy 2: Only Use High-Fee, High-Volume Pools

If you’re going to provide liquidity to volatile pairs, at least give yourself fighting odds. Look for pools with:

- High daily volume: More trades = more fees

- Higher fee tiers: 0.3% or 1% fee pools generate more income than 0.05% pools

- Consistent volume history: Check that volume hasn’t just spiked temporarily

The math still might not work out, but you’re improving your odds compared to low-volume pools where IL will almost certainly outpace fee income.

Strategy 3: Platforms with IL Protection (Bancor, Thorchain)

Some protocols have built-in impermanent loss protection mechanisms. Bancor pioneered this with their 2.1 version, offering full IL protection after 100 days of providing liquidity.

Thorchain offers similar protection on some pools. The trade-off is usually lower base APY or vesting requirements. But for longer-term liquidity provision, the protection can make the math actually work in your favor.

Do your research on these platforms first. Protection mechanisms have limitations and aren’t magic.

Strategy 4: Just Don’t Provide Liquidity (The Honest Answer)

I’m going to be straight with you because I wish someone had been straight with me before I lost that $2,400.

For most retail investors, crypto staking offers better risk-adjusted returns than liquidity provision. You earn yield without the IL risk. Your token count stays constant. The math is simple.

Providing liquidity makes sense for:

- Professional market makers with hedging capabilities

- People farming specific token rewards short-term (and monitoring closely)

- Stablecoin-only strategies

- Those using IL-protected platforms with long time horizons

For everyone else? You’re probably better off staking or just holding. I know that’s not the exciting answer, but it’s the honest one.

The Bottom Line: Should You Provide Liquidity?

Impermanent loss is not a bug in DeFi. It’s a feature of how automated market makers work. You can’t avoid it in volatile pools. You can only decide whether the potential rewards justify the guaranteed cost.

Before depositing into any liquidity pool, run the numbers. Use an impermanent loss calculator to model scenarios. Ask yourself: if this token moves 50% in either direction, will the APY I’m earning cover my losses?

Usually, the answer is no.

My Current Approach

I only provide liquidity in three scenarios now: stablecoin pairs, correlated asset pairs, or short-term farming of new high-APY pools where I’m willing to lose the IL as a cost of farming token rewards. Everything else gets staked or held. My portfolio thanks me for learning this lesson, even if it cost $2,400 in tuition.

The 51% unprofitability stat for Uniswap V3 LPs tells you everything you need to know. More than half of people doing this are losing compared to simply holding. Don’t assume you’ll be in the winning half without a specific edge.

If you’re new to DeFi, start with DeFi yield farming basics and understand gas fees before jumping into liquidity provision. And always, always do the IL math first.

The yield looks attractive until you realize you paid for it with your own gains.