I spent three years with my charts looking like a Jackson Pollock painting – 15 different indicators, 8 moving averages, Fibonacci levels everywhere, trend lines crossing like spaghetti. You know what all those indicators told me? Absolutely nothing useful. They contradicted each other constantly, and I lost $30,000 paralyzed by analysis while trying to get 47 different indicators to align perfectly.

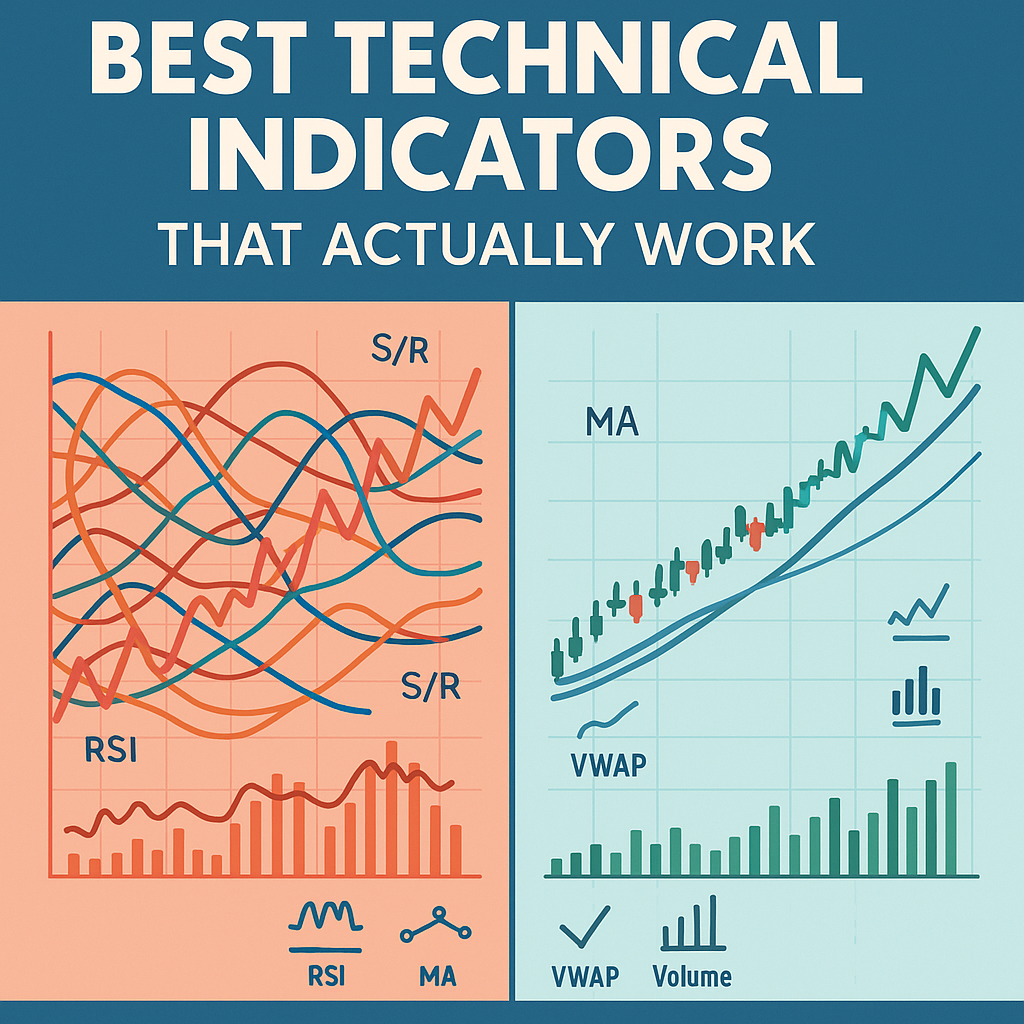

Here’s the truth about technical indicators that no YouTube guru will tell you: 90% of them are the same shit repackaged with different math. RSI, Stochastic, Williams %R – they’re all measuring momentum. MACD, Moving Averages, Bollinger Bands – they’re all showing trend. You don’t need 20 ways to tell you the same thing. You need 3-5 indicators that actually work, and you need to understand what they’re really telling you, not what some textbook says they mean.

After testing literally every indicator that exists (yes, even the weird ones like Ichimoku clouds and Gann fans), I’ve boiled it down to the five that actually make me money, and I’m going to show you exactly how to use them. Plus, I’ll expose the popular indicators that are complete garbage so you can clean up your charts and actually see what’s happening.

The Only 5 Indicators You Actually Need

1. Volume (The Truth Detector)

Volume is the only indicator that can’t lie. Price can be manipulated, patterns can be faked, but volume shows you what’s really happening.

How I Actually Use Volume:

Big green candle with tiny volume = Fake move, don’t trust it

Big green candle with huge volume = Institutions buying, follow them

Price breaking resistance on low volume = Will probably fail

Price breaking resistance on high volume = Real breakout

My $8,000 Volume Trade:

- NVDA approaching $650 resistance

- Tried 3 times with declining volume

- 4th attempt: Volume spike 3x average

- Bought immediately at $651

- Rode to $680 in a week

- Volume told the story

The Volume Rules That Work:

- Breakout volume should be 150%+ of average

- Declining volume in uptrend = exhaustion coming

- Volume precedes price (smart money accumulates quietly)

- No volume = no conviction = no trade

What Volume Actually Tells You:

It’s not about the bars at the bottom. It’s about WHO is trading. Retail trades create noise. Institutional volume creates trends. One million shares from retail is different than one million from Goldman Sachs.

2. Moving Averages (But Only Two)

Forget the rainbow of moving averages. You need exactly two: 20 and 50 period.

Why These Two:

- 20 MA = Short-term trend (1 month of trading)

- 50 MA = Medium-term trend (2.5 months)

- The relationship between them tells you everything

How I Trade MAs:

The Bounce Play:

Stock pulls back to 20 MA in uptrend, bounces = Buy

Success rate: 65%

Real Trade Last Week:

- AAPL in uptrend, pulled to 20 MA at $178

- Bounced with volume

- Bought calls

- Sold at $182

- Profit: $400

The Cross Strategy:

20 MA crosses above 50 MA = Bullish

20 MA crosses below 50 MA = Bearish

But here’s the secret: The cross itself is too late

Watch for the MAs converging – that’s your early signal

The Support/Resistance Reality:

MAs aren’t magic. They work because everyone watches them. It’s self-fulfilling prophecy. The 200 MA especially – it’s like a brick wall because every algo on Wall Street has it programmed.

My MA Disaster Lesson:

Used 5, 10, 20, 50, 100, 200 MAs. Chart looked like rainbow spaghetti. Couldn’t see the actual price action. Missed obvious trades waiting for all MAs to align. Now just 20 and 50. Clarity.

3. RSI – But Not How They Teach It

Everyone says “RSI over 70 = overbought, sell” and “RSI under 30 = oversold, buy.” That’s how you lose money.

How RSI Actually Works:

RSI can stay overbought for weeks in strong trends

RSI can stay oversold for weeks in downtrends

The money is in divergences, not levels

The Divergence Gold Mine:

Bullish Divergence:

Price makes lower low

RSI makes higher low

= Selling exhaustion, reversal coming

My TSLA Divergence Trade:

- TSLA dropped from $250 to $230 (new low)

- RSI went from 25 to 35 (higher low)

- Massive bullish divergence

- Bought at $232

- Sold at $255 two weeks later

- The divergence called the bottom perfectly

The RSI Settings That Matter:

Default is 14 period. I use:

- 9 period for day trading (more responsive)

- 14 period for swing trading (balanced)

- 21 period for position trading (smoother)

The Hidden RSI Secret:

RSI 50 is the real level that matters. Above 50 = bullish momentum. Below 50 = bearish momentum. Forget 70 and 30.

4. VWAP (The Intraday Compass)

Volume Weighted Average Price – where the big money actually traded.

Why VWAP Is God-Tier for Day Trading:

It resets every day (no historical baggage)

Shows you true average price including volume

Institutions use it for execution benchmarks

Acts as a magnet for price

How I Trade VWAP:

The Bounce Trade:

Strong stock pulls to VWAP, buy the bounce

Success rate: 70% on trend days

The Fade Trade:

Weak stock rallies to VWAP, short the rejection

Success rate: 68% on down days

This Morning’s VWAP Trade:

- SPY opened strong, ran up to $482

- Pulled back to VWAP at $480.50

- Bounced immediately with volume

- Bought 100 shares

- Sold at $481.80

- $130 profit in 15 minutes

VWAP Bands Strategy:

Add standard deviation bands to VWAP

- Price at upper band = stretched, may pull back

- Price at lower band = oversold, may bounce

- Break of bands with volume = strong move coming

The Institutional Tell:

If a stock closes above VWAP, institutions were net buyers. Below VWAP, they were net sellers. This tells you what smart money really thinks.

5. Support and Resistance (The Only Indicator That’s Not Really an Indicator)

Horizontal lines. That’s it. The most powerful “indicator” is drawing straight lines at previous highs and lows.

How to Find Real S/R:

Look for areas where price bounced multiple times

The more touches, the stronger the level

Round numbers are psychological S/R ($100, $50, etc.)

Previous breakout points become support

My SPY Support Trade Yesterday:

- SPY has bounced off $478 four times this month

- Yesterday dropped to $478.20

- Bought calls immediately

- SPY bounced to $481

- Sold for 40% gain

- The line did all the work

Dynamic S/R (The Advanced Stuff):

- Previous day’s high/low

- Weekly and monthly pivots

- Gap fills

- Options max pain levels

The S/R Psychology:

These levels work because:

- Buyers remember where they bought (support)

- Sellers remember where they sold (resistance)

- Algorithms are programmed with these levels

- Everyone sees the same lines

The Indicators That Are Complete Garbage

Bollinger Bands (The Rubber Band Myth)

“Price returns to the mean!” No, it doesn’t. I’ve seen stocks ride the upper band for months. Lost $5,000 shorting “overbought” conditions that never reversed.

Stochastic (RSI’s Useless Cousin)

Does the same thing as RSI but worse. Gives more false signals. If you’re using both RSI and Stochastic, you’re just confusing yourself.

MACD (The Lagging Disaster)

By the time MACD crosses, the move is over. It’s like driving using only your rearview mirror. Lost countless trades waiting for MACD confirmation that came too late.

Fibonacci Retracements (The Mystical Nonsense)

38.2%, 50%, 61.8% – it’s astrology for traders. Sometimes price stops there, sometimes it doesn’t. You can make any chart “work” with enough Fib levels. Complete confirmation bias.

My Fibonacci Disaster:

Drew Fibs on AMZN, convinced myself 61.8% was “guaranteed” support. Bought heavily. It sliced through like butter. Lost $3,000 believing in magical ratios.

Ichimoku Cloud (The Overwhelming Mess)

Five different lines creating a “cloud”? It’s just complicated moving averages. Makes your chart unreadable. Used it for a month, made zero profitable trades.

Elliott Wave (The Hindsight Theory)

“We’re in wave 3 of 5!” Until you’re not and it was actually wave C of an ABC correction. You can always make the waves fit after the fact. Useless for actual trading.

Pivot Points (The Arbitrary Lines)

Mathematical calculations that create “support and resistance.” Except the market doesn’t care about your math. Real S/R comes from actual trading, not formulas.

How to Combine Indicators (The Right Way)

The Power Combo: Volume + MA + S/R

Setup:

- Stock at 50 MA

- Previous resistance now acting as support

- Volume spike

Example Trade:

- MSFT at 50 MA ($370)

- Previous resistance at $370

- Volume 2x average

- Bought 100 shares

- Rode to $380

- Triple confirmation = higher probability

The Day Trading Trinity: VWAP + RSI + Volume

Setup:

- Price bounces off VWAP

- RSI divergence

- Volume confirmation

This combination gives me 70%+ win rate on day trades.

The Swing Trading Setup: MA Cross + S/R + RSI

Setup:

- 20 MA crossing above 50 MA

- Breaking horizontal resistance

- RSI above 50 and rising

This is my bread and butter swing setup.

My Indicator Evolution (What I Actually Use Now)

2018 (Indicator Vomit Phase)

- 15+ indicators on every chart

- Paralysis by analysis

- Lost money consistently

- Couldn’t see price through the indicators

2020 (The Simplification)

- Reduced to 7 indicators

- Still too many

- Some improvement

- Started being profitable

2025 (Current Setup)

Day Trading Chart:

- VWAP with bands

- Volume

- 20 MA

- That’s it

Swing Trading Chart:

- 20 and 50 MA

- Volume

- RSI (hidden, check occasionally)

- Horizontal S/R lines

Results: Best trading year ever. Less is more.

The Settings That Actually Matter

Moving Averages

- Use EMA for day trading (more responsive)

- Use SMA for swing trading (smoother)

- 20 and 50 period only

RSI

- 9 period for volatile stocks

- 14 period for normal stocks

- 21 period for slow movers

Volume

- Show as histogram

- Color code (green/red)

- Include moving average of volume

VWAP

- Include standard deviation bands

- Set to 1 and 2 deviations

- Hide after hours (misleading)

Common Indicator Mistakes That Cost Me Money

Mistake 1: Indicator Shopping

Lost trade? Add another indicator! Still losing? Add another! Had 20 indicators and couldn’t make a decision. Information overload.

Mistake 2: Trusting Indicators Over Price

“RSI says oversold, must buy!” Stock kept dropping. Indicators are tools, not gospel. Price pays, everything else is noise.

Mistake 3: Not Understanding What Indicators Measure

Used MACD and Moving Averages together. They’re measuring the same thing (trend). Redundant information, no edge.

Mistake 4: Default Settings on Everything

Never questioned why RSI is 14 period. Why moving averages are 50 and 200. Started testing different settings, found what works for my style.

Mistake 5: Looking for the “Holy Grail” Indicator

Spent $2,000 on “proprietary indicators.” They were just RSI with different math. There’s no secret indicator. The basics work if you use them right.

The Truth About Indicators

After 6 years and probably 10,000 hours staring at charts, here’s what I know:

Indicators don’t predict the future. They describe the past and present. The future is uncertain, always.

Price and volume are all that matter. Everything else is derivative. If you can read price action and volume, you don’t need indicators.

Simple beats complex. My best trades come from obvious setups a child could see. The more complex your system, the more ways it can fail.

Indicators are training wheels. Useful when learning, but eventually you should be able to read the market without them.

Consistency beats optimization. Pick your indicators and stick with them. Constantly changing is why you lose.

Your 30-Day Indicator Challenge

Week 1: Remove all indicators. Trade with just price and volume. It will be uncomfortable. Do it anyway.

Week 2: Add back ONE moving average (20 period). See how it helps or hurts.

Week 3: Add either RSI or VWAP (not both). Notice the difference.

Week 4: Add S/R lines. This should be your complete setup.

After 30 days, you’ll see charts clearly for the first time. You’ll make better trades with 3 indicators than you ever did with 15.

The Bottom Line

The best traders I know use the fewest indicators. They’re reading price action, not derivative mathematics. They understand that indicators are confirmation tools, not prediction machines.

My charts used to look like Christmas trees. Now they look like charts. I can see what’s actually happening instead of what indicators think might happen. That clarity has made me more money than any indicator ever could.

Start with price and volume. Master those. Add indicators sparingly, understanding what each one actually tells you. And please, for the love of all that’s holy, stop looking for the magical indicator that will make you rich. It doesn’t exist.

The market has been traded successfully for hundreds of years before computers and indicators existed. Price goes up or down. Volume is high or low. That’s all you really need to know. Everything else is just expensive decoration.