Alright, let’s talk about the Greeks. No, not the people who gave us democracy and gyros – I’m talking about Delta, Gamma, Theta, Vega, and their bastard cousin Rho that nobody cares about. These are the forces that control whether your options make money or turn into expensive toilet paper.

Here’s the thing – every options education resource makes the Greeks sound like rocket science. They throw formulas at you, talk about “partial derivatives,” and show graphs that look like they’re from a physics textbook. Screw that. I’m going to explain the Greeks like you’re five years old, because that’s how I wish someone had explained them to me before I lost $10,000 not understanding what theta decay meant.

I learned about the Greeks the hard way. Bought Apple calls with 3 days to expiration, stock went up $2, and my options still lost money. “How the hell is this possible?” I screamed at my monitor. That’s when I discovered theta – the silent killer that was eating $50 per day from my options while I slept. If I’d understood the Greeks from the start, I’d have saved myself thousands in tuition to the School of Expensive Mistakes.

Think of the Greeks as the dashboard of your car. You don’t need to understand how the engine works to drive, but you better know what that speedometer and fuel gauge are telling you, or you’re going to have a bad time. The Greeks are your options dashboard – ignore them at your own peril.

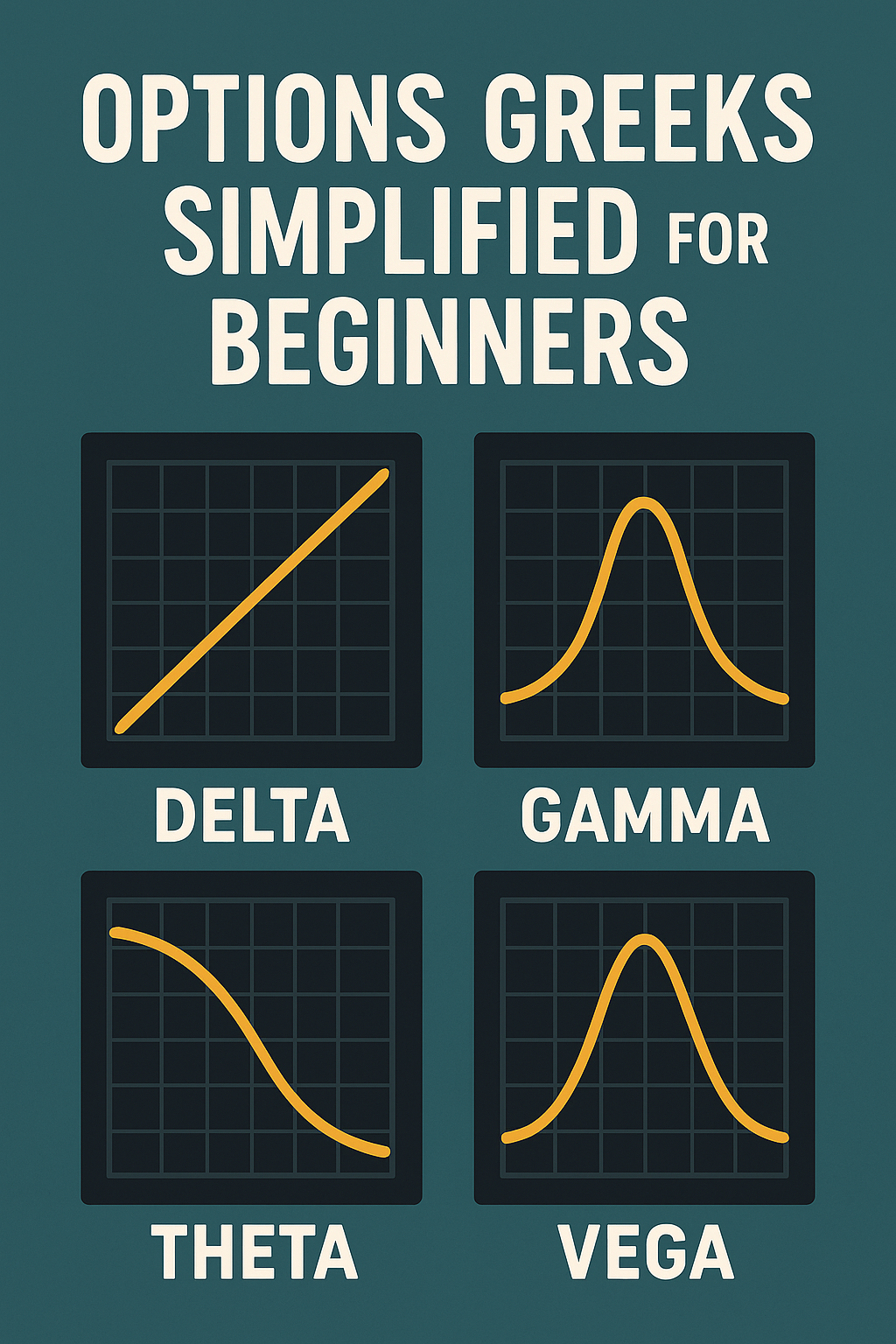

Delta: The “How Much Will I Make?” Greek

Delta is the easiest Greek to understand and arguably the most important. It tells you how much your option will move for every $1 the stock moves. That’s it. No complicated math needed.

Get a VPS from as low as $11/year! WOW!

Delta in Real Life

If you have a call option with a delta of 0.50, and the stock goes up $1, your option goes up $0.50. Stock goes up $10? Your option goes up $5. It’s literally that simple.

Real Example from Last Week:

- Bought NVDA $650 call with 0.40 delta for $8.00

- NVDA went from $645 to $655 (up $10)

- Option should go up: $10 × 0.40 = $4.00

- Option actually went to $12.20 (it went up $4.20)

- Extra $0.20 from other Greeks (we’ll get there)

What Delta Really Tells You

Here’s the secret nobody mentions – delta is also roughly the probability your option expires in the money. A 0.30 delta option has about a 30% chance of expiring ITM. A 0.70 delta? 70% chance. This completely changed how I select strikes.

How I Use Delta:

- Buying options: I want 0.40-0.60 delta (decent probability, reasonable cost)

- Selling options: I want 0.20-0.30 delta (high probability they expire worthless)

- Day trading: 0.70+ delta (acts more like stock)

The Delta Mistakes That Cost Me Money

Mistake 1: Buying 0.10 delta options because they were “cheap”

- Stock needs to move 10% just for these to have value

- They’re cheap for a reason – they’re probably worthless

Mistake 2: Not understanding delta changes

- Bought 0.50 delta calls

- Stock dropped, delta became 0.30

- Now need even bigger move to recover

- This is called “delta decay” and it’s a bitch

Delta Rules for Not Losing Your Ass

- Never buy options with delta less than 0.25 (lottery tickets)

- For directional trades, aim for 0.40-0.60 delta

- Remember delta changes as stock moves (that’s gamma)

- ATM options have ~0.50 delta

- Deep ITM options have ~1.00 delta (move dollar for dollar with stock)

Gamma: The “Acceleration” Greek

If delta is your speed, gamma is your acceleration. It tells you how fast your delta changes as the stock moves. This is where things get spicy.

Why Gamma Matters (A Lot)

Gamma is why weekly options can make or lose you 500% in a day. High gamma means your delta is changing rapidly, which means your option value is going parabolic (or to zero).

My Tesla Gamma Explosion:

- Bought TSLA $800 calls expiring in 2 days

- Delta: 0.30, Gamma: 0.05

- Tesla moved from $795 to $810

- Delta increased from 0.30 to 0.75 (gamma effect)

- Option went from $3 to $15

- 400% gain because gamma went nuts

But here’s the dark side – gamma works both ways. That same option went to $0.50 the next day when Tesla pulled back to $798. Gamma giveth, and gamma absolutely destroyeth.

When Gamma Goes Crazy

Gamma is highest for:

- ATM options (right at the strike price)

- Options close to expiration

- Weekly options (gamma on steroids)

Real Numbers Example:

- SPY at $480

- $480 call expiring in 30 days: Gamma = 0.01

- $480 call expiring tomorrow: Gamma = 0.08

- Same strike, 8x more gamma near expiration

This is why I call weekly options “gamma bombs” – one small move and BOOM.

How to Use Gamma Without Getting Destroyed

For Buyers:

- Want high gamma for explosive moves

- Buy ATM options 0-7 days out

- Set tight stops (gamma cuts both ways)

- Take profits quickly (don’t get greedy)

For Sellers:

- Avoid high gamma like the plague

- Sell options 30-45 days out

- Stay away from ATM strikes

- Never sell naked options near expiration

My Gamma Trading Strategy

I call this the “Gamma Scalp”:

- Find stock consolidating near round number

- Buy ATM straddle 2-3 days from expiration

- When stock breaks either direction, gamma explodes

- Sell the winning side for 100-200% gain

- Hold losing side in case of reversal

Made $8,000 last month just trading gamma explosions on SPY and QQQ.

Theta: The “Time Killer” Greek

Theta is the grim reaper of options. It’s how much value your option loses each day just from time passing. Even if the stock doesn’t move, theta is eating your premium like termites in a wood house.

The Theta Decay Curve (Or: Why Timing Matters)

Theta isn’t linear – it accelerates exponentially as expiration approaches. This completely screwed me when I started trading.

The Brutal Reality:

- 60 days out: Losing $0.02/day (no big deal)

- 30 days out: Losing $0.05/day (starting to notice)

- 14 days out: Losing $0.10/day (okay this hurts)

- 7 days out: Losing $0.20/day (what the hell)

- 1 day out: Losing $0.50/day (goodbye money)

Real Loss from Last Month:

- Bought AAPL $180 calls 5 days out for $2.00

- Theta: -$0.30/day

- Held for 3 days, stock didn’t move

- Lost $0.90 (45%) just to theta

- Sold for $1.10 even though I was right about direction

How to Make Theta Your Friend

Instead of fighting theta, join the dark side and sell options:

My Theta Income Strategy:

- Sell options 30-45 days out (sweet spot for decay)

- Collect 1/3 of the width in credit

- Buy back at 50% profit (usually 15-20 days)

- Theta pays me every single day

Example Trade:

- Sold SPY $470/$465 put spread for $1.50

- Theta: +$0.08/day (I’m collecting this)

- After 10 days, worth $0.75

- Buy back for 50% profit

- Theta paid me $0.80 while I waited

The Theta Rules That Save Me Money

- Never buy options with less than 30 days unless day trading

- If theta is more than 10% of option price, it’s too high

- Sell weekly options, buy monthly options

- Close losing long options if theta > option price movement

- Weekend theta is real (market closed, decay continues)

Theta Gang Strategy That Prints

Every Monday morning:

- Sell 45 DTE iron condors on SPY

- Collect $200 in premium

- Theta: +$4.50/day

- Close at 50% profit (usually 20 days)

- Make $100 in 20 days = 25% ROI

Do this every week with proper sizing, and you’re making $400-500/month just from theta decay.

Vega: The “Volatility Wildcard” Greek

Vega is the most misunderstood Greek, and it’s cost me more money than all the others combined. Vega measures how much your option value changes when implied volatility changes. And let me tell you, this sneaky bastard will ruin your day.

The Earnings Crush That Taught Me About Vega

My most expensive vega lesson:

- Netflix earnings coming up

- Bought $500 calls for $15 (stock at $490)

- IV was 80% (didn’t know what this meant)

- Netflix beats earnings, stock goes to $510

- I should be rich, right? WRONG

- IV crushed to 30% post-earnings

- Options worth $12

- Lost money even though I was right

That’s vega, folks. The option lost $8 from volatility crush but only gained $5 from the stock move. Net loss: $3 per contract on a winning trade.

How to See Vega Coming

High Vega Situations:

- Before earnings (IV typically 50-100%+)

- Before FDA approvals

- Before Fed announcements

- During market panic (VIX above 30)

- Meme stock mania

My Vega Checklist:

- Check IV rank (where is IV vs past year?)

- If IV rank > 70%, I’m selling not buying

- If IV rank < 30%, buying is okay

- Compare to historical volatility

- Never buy high vega before binary events

The Vega Arbitrage Strategy

Here’s how I make money from vega instead of losing to it:

Before Earnings:

- IV spikes from 30% to 80%

- Sell iron condors or strangles

- Collect massive premium

- After earnings, IV crushes

- Buy back for 30-50% of what I sold for

Real Netflix Trade:

- Day before earnings: Sold $450/$550 strangle for $20

- After earnings: Stock at $495 (right in the middle)

- IV crushed from 85% to 35%

- Bought back strangle for $5

- Profit: $1,500 on $5,000 risk

Vega Rules for Survival

- Always check IV before trading

- High IV = sell premium, don’t buy

- Low IV = okay to buy options

- Vega highest for ATM options

- Longer expiration = more vega exposure

- Use vega to your advantage, not against you

Rho: The Greek Nobody Cares About

Rho measures sensitivity to interest rate changes. Unless you’re trading LEAPS or interest rates are going crazy, ignore rho. Seriously.

The only time rho mattered to me: Had SPY LEAPS during the 2022 rate hikes. Lost an extra $500 to rho as rates went from 0% to 5%. For weekly or monthly options? Rho might change your option value by $0.01. Not worth the brain space.

How The Greeks Work Together (The Orchestra Effect)

The Greeks don’t work in isolation – they’re like an orchestra where every instrument affects the overall sound. Understanding how they interact is what separates profitable traders from donation machines.

The Daily Battle in Your Options

Every day, your options face this fight:

- Delta pushes value up if stock moves your way

- Theta pulls value down from time decay

- Gamma amplifies delta’s effect (good or bad)

- Vega swings value based on fear/greed in market

Real Example from My Account:

- Own TSLA $850 calls, 10 days to expiration

- Delta: 0.35 (need stock to move up)

- Theta: -$0.45/day (losing money to time)

- Gamma: 0.03 (delta changing quickly)

- Vega: 0.30 (sensitive to volatility)

What Happened Over 3 Days:

- Day 1: TSLA up $5, IV unchanged → Option up $1.30 (delta gain – theta loss)

- Day 2: TSLA flat, IV drops 5% → Option down $1.95 (theta + vega loss)

- Day 3: TSLA up $15, IV up 10% → Option up $8.50 (everything working)

The option went from $10 to $9.30 to $7.35 to $15.85. Wild ride, all because of Greeks fighting each other.

The Perfect Storm Setup

When all Greeks align in your favor, magic happens:

My Best Trade Ever:

- SPY selloff to $450 support

- Bought $455 calls 3 days out for $0.50

- Delta: 0.25 (cheap but responsive)

- Gamma: 0.05 (ready to explode)

- Theta: -$0.10 (manageable for quick trade)

- Vega: 0.15 (IV was crushed from selloff)

- Next day: Fed speaks dovish

- SPY rockets to $460, IV spikes

- All Greeks worked in my favor

- Calls went to $5.50 (1,000% gain)

This happens maybe once a month if you’re watching. The key is recognizing when Greeks align.

Greeks-Based Strategies That Actually Work

Strategy 1: The Delta-Neutral Theta Farm

Sell equal delta on both sides, collect theta:

- Sell 0.30 delta call

- Sell 0.30 delta put

- Net delta: ~0 (market neutral)

- Collect theta from both sides

- Adjust if delta gets skewed

Making $2,000/month with this on SPY and QQQ.

Strategy 2: The Gamma Squeeze Hunt

Find stocks with huge gamma concentration:

- High open interest at specific strike

- Stock approaching that strike

- Buy options 2 strikes away

- When stock hits max gamma strike, explosive move

- Ride the gamma squeeze

Caught GME, AMC, and BBBY squeezes with this method.

Strategy 3: The Vega Harvest

Systematic volatility selling:

- Scan for IV rank > 75%

- Sell 45 DTE strangles

- Close at 25% profit (usually 5-10 days)

- Vega crush does the work

70% win rate, average profit $300 per trade.

Strategy 4: The Theta Acceleration Play

Buy options right before theta decay accelerates:

- Buy 60 DTE options

- Sell at 35 DTE (before acceleration)

- Avoid the theta decay cliff

- Focus on delta gains only

Simple but effective for swing trading.

Common Greeks Mistakes That Will Empty Your Account

Mistake 1: Ignoring Theta on Long Options

Bought Microsoft calls with 5 days to expiration because they were “cheap.” Theta was -$0.40/day on a $2.00 option. Stock went sideways for 3 days. Lost 60% to time decay alone. Now I never buy less than 30 DTE unless day trading.

Mistake 2: Not Understanding Vega During Events

Bought puts before CPI data because I thought inflation would spike. It did. Market tanked. My puts lost money. Why? Vega crush after the event. IV went from 40% to 20%. Learned to sell premium before events, not buy it.

Mistake 3: Fighting Gamma Near Expiration

Sold “safe” iron condors with 2 days to expiration. SPY moved 1%. Gamma explosion blew through my strikes. Lost $3,000 on what should have been a $200 winner. Never sell options inside 7 DTE now.

Mistake 4: Chasing Delta Without Considering Other Greeks

Bought 0.90 delta LEAPS thinking they’d act like stock. Forgot about vega. Market volatility dropped from 30% to 15% over two months. Lost $2,000 to vega while stock went sideways. Now I check all Greeks, not just delta.

Mistake 5: Misunderstanding Greek Relationships

Thought high gamma was always good for buyers. Bought ATM weeklies. Gamma worked against me as stock dropped. Delta went from 0.50 to 0.10 in one day. $1,000 position became $100. Gamma accelerates moves in BOTH directions.

Your Greeks Cheat Sheet for Not Losing Money

Delta Cheat Sheet:

- Calls: 0 to 1.0 (positive)

- Puts: 0 to -1.0 (negative)

- ATM: ~0.50

- Use for: Directional exposure

- Warning: Changes with stock movement

Gamma Cheat Sheet:

- Highest: ATM, near expiration

- Lowest: Deep ITM/OTM, far expiration

- Use for: Explosive moves

- Warning: Double-edged sword

Theta Cheat Sheet:

- Accelerates last 30 days

- Highest: ATM options

- Use for: Income generation (selling)

- Warning: Weekends count

Vega Cheat Sheet:

- Highest: ATM, far expiration

- Check IV rank before trading

- Use for: Volatility trades

- Warning: Crushes after events

Position Selection Based on Greeks:

- Want direction? Focus on delta

- Want explosion? Focus on gamma

- Want income? Focus on theta

- Think volatility changing? Focus on vega

The Greeks Dashboard Method

Here’s how I actually use Greeks in my trading:

Before Entering Any Trade:

- Check delta (directional risk)

- Check theta (time cost)

- Check vega (volatility risk)

- Calculate theta/delta ratio

- If theta > 20% of delta, pass

Daily Position Management:

- Morning: Check overnight Greek changes

- Adjust if delta gets too skewed

- Close if theta > daily profit potential

- Roll if gamma getting dangerous

The Greeks Tell You When to Exit:

- Delta flipped negative? Direction changed, get out

- Theta exceeding delta gains? Time decay winning, close

- Gamma too high? Risk exploding, reduce position

- Vega exposure before event? Sell or hedge

Your 30-Day Greeks Mastery Plan

Week 1: Master Delta

- Track delta on all trades

- Note how it changes with stock movement

- Practice selecting strikes based on delta

Week 2: Add Theta

- Calculate daily theta cost

- Compare theta to expected daily moves

- Avoid high theta positions

Week 3: Understand Gamma and Vega

- Watch gamma near expiration

- Track IV changes and vega impact

- Note how they affect your P&L

Week 4: Integrate Everything

- Evaluate all Greeks before trading

- Use Greeks to size positions

- Let Greeks guide exits

After 30 days, you’ll read Greeks like a second language.

The Truth About Trading with Greeks

Here’s the reality: Greeks won’t make you a profitable trader by themselves. They’re just measurements, like a speedometer. Knowing you’re going 100 mph doesn’t prevent you from crashing.

But NOT understanding Greeks is like driving blindfolded. You might get lucky and reach your destination, but you’ll probably wrap your car around a tree.

I spent my first year trading options completely ignoring Greeks. Lost $25,000. Spent three months learning Greeks, applying them to every trade. Next year made $40,000. The difference? I stopped fighting invisible forces I didn’t understand.

Greeks tell you what’s happening to your options every second. Delta shows if you’re winning directionally. Theta shows the time cost. Gamma warns of acceleration. Vega reveals volatility risk. Together, they’re your radar system for navigating options.

The most successful options traders I know can quote Greeks in their sleep. Not because they’re math nerds, but because Greeks tell them exactly what risks they’re taking and why their positions are making or losing money.

Start simple. Focus on delta and theta first. Add gamma and vega as you get comfortable. Within a few months, you’ll wonder how you ever traded without them. Greeks turn options from gambling into calculated risk-taking.

Master the Greeks, and you master options. Ignore them, and the market will teach you expensive lessons about forces you never saw coming. Your choice.